If you haven’t already read “What is Artificial Affluence” stop now and read that post for a detailed explanation. This post will detail the fiscal lives of The Averages to explore what artificial affluence looks like to help you determine if you might also be living in a state of artificial affluence.

In case you need a quick refresher, here’s what I think artificial affluence is.

What is artificial affluence?

- Artificial affluence is a hallucination of financial stability, even wealth, due to decent income and stable employment.

- Artificial affluence is maintaining a lifestyle through deficit spending via loans or credit

- Artificial affluence means not saving sufficiently for current or future needs.

- Artificial affluence is financial ignorance and dependence vs. financial independence.

Symptoms of artificial affluence

Artificial affluence occurs when one or more of the following are in place:

- Spending more or about the same as you take home each month,

- Lacking clarity about how much you spend on expenses each month,

- A disproportionate amount of spending each month is toward debt — mortgage, rent, credit card debt, and/or student loans,

- ‘Covering’ extra or larger expenses with a credit card or other debt,

- Sustaining or growing credit card balances, and/or

- Not setting aside any/enough money for an emergency fund, savings, and retirement.

Understanding artificial affluence with The Averages

We’re going to crunch some hard numbers to demonstrate what artificial affluence looks like and how common it can be. While your own situation may be different, this family of four will give us a fiscal sandbox to better understand artificial affluence. A few caveats are in order

- When dealing with personal finance, averages need to be taken with a grain of salt. Let’s call this the Bezos/Musk Effect. A few really rich people (or really poor people) can skew averages in pretty significant ways. That said, among educators there is likely a far more equal income distribution than, say, among those who work for Amazon.

- Among schools, districts, regions, and states, educator pay varies. Below, I’m referencing examples from the Pacific Northwest. Your numbers may look different.

Acknowledging these considerations, I’m going to use The Averages, a fictional ‘typical’ educator family to help illustrate what I mean by artificial affluence. Feel free to plug in your own numbers to see how you compare.

We’re going to start with cash flow — an examination of income and costs on month-to-month basis. We’ll then examine wealth a.k.a. net worth in the next post.

Artificial affluence and cash flow

Understanding cash flow is essential to determining your financial health and determining if you are living in a state of artificial affluence.

There are two components of cash flow — income and costs, calculated either monthly or yearly.

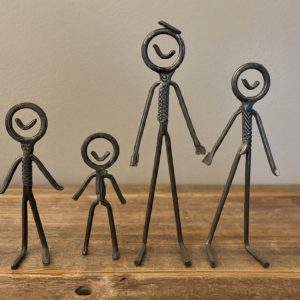

To help us understand cash flow (and artificial affluence), let’s take a look at The Averages. Both parents are educators. Let’s say they are both 35 years old. And their two kids are charming.

Income

Acknowledging that educator pay varies greatly from state to state and often district to district, according to USA Facts, the average teacher salary in the U.S. was $66,397 in 2022. Here in the Pacific Northwest, the averages were as follows

- Idaho – $54,232

- Oregon – $69,671

- Washington – $81,586

Not a teacher? Here are some other national averages for some other educator roles, one a bit higher than teachers and other lower than teachers.

- The national average for principals was $98,420, according to Career Explorer.

- The national average for educational assistants was $54,981, according to Indeed.

All of these salaries are gross wages before taxes.

Let’s return to the Average Family. One parent is a teacher and one is an educational assistant. And let’s say they live in Oregon. For the sake of simplicity, we’ve rounded out the before-tax salaries.

- Parent #1 makes $70,000

- Parent #2 makes $50,000

The Averages have an annual total gross income of $120,000.

Now we need to account for income taxes. Using the tax calculator at Smart Asset, this couple would take home about $90000 after Oregon and Federal taxes.

The Averages have an after-tax take home pay of $90,000.

While your income may be lesser or greater than The Averages, for the purposes of this illustration, that’s okay. I’m using The Averages to help you understand cash flow and artificial affluence and it’s easier to point at others’ financial situation than examine our own. Feel free to jot down how your numbers compare with theirs.

Costs

Artificial affluence doesn’t have to look flashy.

- The Average Family may have two cars (each parent works) and one is a nicer SUV to haul the kids around and keep up with the Joneses.

- They may live in a nicer and more expensive neighborhood because, after all, they know where the good schools are.

- The Average Kids want the latest iPhones because everyone at their school has one!

- Did I mention the Average kids attend soccer camp and take music lessons?

- Oh, and the Averages love to visit grandpa and grandma who live near Disney World.

To all outward appearances, the Average Family is much like other two child educator families in their community. They may not even appear to be ‘affluent’ or ‘well off.’

According to Ramsey Solutions, the average monthly living expenses in the U.S. for a family of four is “between $7,333 to $8,595 (depending on the ages of your kids).”

To keep calculations simple, let’s aim for a rough median of $8000 in household costs a month. Keep in mind that this is a national average. Key costs like housing and car prices can vary significantly from across the U.S. and even within a specific state. If we multiply $8000 by 12 months, The Averages have yearly living expenses of $96,000.

The Averages have annual living expenses of $96,000.

Are the Averages artificially affluent?

Let’s do a quick bit of math.

Based on cash flow, The Averages appear to be artificially affluent for the following reason:

- Spending more or about the same as you take home each month.

The Averages have an after-tax take home pay of $90,000.

The Averages have annual living expenses of $96,000.

The Averages have an annual shortfall of $6000.

Artificial affluence includes both cash flow and net worth. The next post will look at what The Averages are worth. To learn more about how artificial affluence can impact authentic wealth, click on the link below to keep reading.

Artificial affluence is a hallucination of financial stability, even wealth, due to decent income and stable employment. If you are living paycheck to paycheck or sustaining your lifestyle through deficit spending via loans or credit, read on!

This is a FIRE Me 201 post.

Click on the hourglass or link to find more articles in this collection.